Cloud Discount Instruments: From Tactical to Strategic

A high level guide for engineering leads

Introduction

Cloud discount instruments fall into two main categories: tactical tools available to all customers, and strategic agreements for high-volume users. Understanding both is essential for effective FinOps management, as these instruments can deliver substantial savings but also create long-term commitments that affect operational flexibility.

This guide covers the spectrum from basic reservations through enterprise discount programs, explaining how each works, their benefits, and their potential drawbacks.

Tactical Instruments: Reservations and Savings Plans

These discount mechanisms are available to all cloud customers and typically focus on compute resources and compute-adjacent services like managed databases. They represent the most visible tools in the FinOps toolkit, offering significant discounts in exchange for usage commitments.

Resource-Based Discounts (The First Generation)

AWS and Azure: Called "Reservations"

GCP: Called "Committed Use Discounts" (CUDs)

These original discount instruments work by "reserving" specific instance types or families. You commit to using a particular configuration for one or three years, with three-year commitments typically offering discounts up to 70% off on-demand pricing.

The fundamental challenge with resource-based discounts becomes apparent at scale. You're essentially managing a complex inventory matching system where thousands of virtual machines must align with specific reservation configurations. If you need to upgrade an instance type, your existing reservation becomes invalid, creating a double penalty where you pay both for the new on-demand instance and the unused reservation.

Amazon attempted to address this with "convertible reservations," but these still required constant management of both resource inventory and reservation inventory, making them impractical for dynamic environments.

Spend-Based Discounts (The Evolution)

AWS and Azure: Called "Savings Plans"

GCP: Called "Flex CUDs"

The industry evolved toward spend-based commitments to solve the inventory management problem. Instead of committing to specific instance types, you commit to an hourly spend amount for one or three years.

For example, if you consistently spend $100 per hour on compute resources, you can purchase a three-year Savings Plan that discounts that spend by approximately 50%, reducing your effective hourly cost to $50. Crucially, this discount applies regardless of which specific instance types you use, as long as your total eligible spend meets the commitment level.

The advantages of this approach are significant. You eliminate the chronic mismatch problem where you're simultaneously paying for unused reservations and on-demand instances. You're now managing a single pool of committed spend rather than hundreds of individual resource reservations. Additionally, you're free to upgrade to newer, more efficient instance types without losing your discount, which benefits both your performance and the cloud provider's hardware refresh cycles.

Payment Structure and Financial Considerations

Both reservation types offer payment flexibility that requires collaboration between FinOps and Finance teams. Most cloud providers allow you to pay zero, fifty, or one hundred percent of your commitment upfront, with deeper discounts available for full upfront payment.

The financial calculation becomes a time-value-of-money analysis. In low-interest-rate environments, paying upfront for deeper discounts makes sense. In higher-interest-rate environments, you must weigh the additional discount against the opportunity cost of tying up that capital.

If you choose partial or no-upfront payment, you'll have recurring charges equal to your commitment minus any upfront payment, billed hourly throughout the commitment term.

The Optimization Paradox

Commitment-based discounts create an interesting challenge in optimization-focused environments. During growth phases, expanding commitments is straightforward. However, when business priorities shift toward efficiency and cost reduction, these commitments can become constraints.

If you successfully optimize your infrastructure and reduce resource usage, you may find yourself paying for committed capacity you no longer need. This creates a situation where optimization efforts improve resource efficiency but potentially increase per-unit costs due to unused commitments. The key is coordinating capacity planning with commitment management to avoid this trap.

Strategic Instruments: Enterprise Discount Programs (EDPs)

Once annual cloud spend crosses significant thresholds - typically around $1 million - organizations should explore enterprise discount programs. These function similarly to enterprise sales relationships in other industries, offering deeper discounts in exchange for larger, longer-term commitments.

Comprehensive Discount Coverage

The primary attraction of EDPs is their breadth. While tactical instruments mostly cover compute resources, EDPs typically offer discounts across your entire cloud bill. This includes storage, networking, data transfer, managed services, and all the ancillary costs that accumulate in cloud environments.

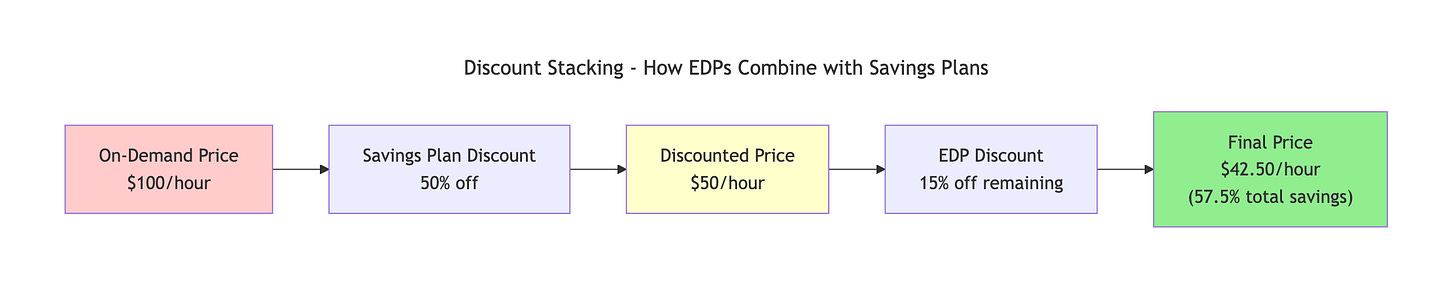

These discounts are substantial - often 10-15% across everything—and stack with existing savings plans and reservations. For compute resources already discounted 50% through savings plans, an additional EDP discount can bring total savings to 60% or more off list prices.

Credits and Additional Benefits

Most EDP agreements include annual credit allocations that function like prepaid account credits. These credits can represent an additional 3-7% savings on annual spend when applied strategically. However, credits require careful management as they typically expire annually and must be consumed within specific timeframes.

The Commitment Structure

EDPs require substantial annual spending commitments, typically structured as minimum annual targets over multi-year periods. These commitments are designed to be achievable only for organizations in consistent growth mode, which aligns with the cloud provider's revenue goals but can create challenges when business priorities shift.

The total contract value usually exceeds the sum of annual minimums, creating additional financial obligations. A four-year agreement with $5 million annual minimums might have a $25+ million total contract value, effectively increasing the true annual commitment.

Shortfall Mechanisms and Their Implications

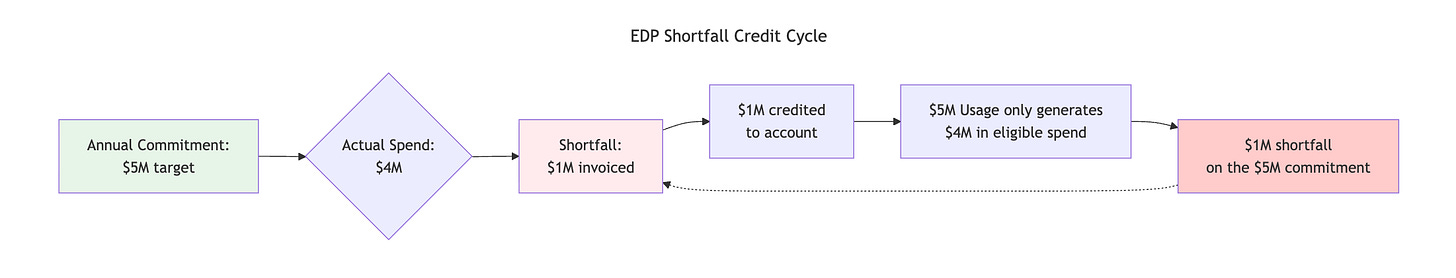

When organizations fail to meet annual spending targets, providers typically invoice the shortfall amount. However, this often functions as an accounting mechanism rather than a pure penalty. The shortfall payment is usually applied back to the account as credits, but these credits can create a problematic cycle.

Credits reduce your billed usage, which counts toward your commitment target. If you're already struggling to meet spending minimums, receiving credits actually makes it harder to reach future targets, potentially creating a downward spiral of shortfalls and additional credit accumulation.

Cash Basis Accounting and Strategic Timing

EDPs operate on cash basis accounting, meaning upfront payments for savings plans and reservations count toward annual commitment targets in the year they're paid, not when the underlying usage occurs. This creates opportunities for strategic financial management.

Organizations can time large upfront payments to coincide with challenging commitment years, effectively borrowing spending credit from future years. However, this requires careful coordination between FinOps and Finance teams to manage cash flow and ensure commitments remain achievable across the entire contract term.

Strategic Considerations and Risk Management

Both tactical and strategic discount instruments require careful balance between savings optimization and operational flexibility. The key considerations include:

Growth Planning: Commitments should align with realistic growth projections, not optimistic scenarios that may not materialize.

Optimization Impact: Consider how efficiency initiatives might affect committed spending levels and plan accordingly.

Contract Timing: Stagger commitment expirations to maintain flexibility for renegotiation or strategic changes.

Multi-Cloud Consistency: Ensure discount strategies work coherently across multiple cloud providers rather than optimizing each in isolation.

The ultimate goal is maximizing savings while maintaining the operational agility that makes cloud computing valuable in the first place.